Industrial Septic Tank Emptying

£175.00 – £570.00

For industrial users, subject to VAT. See full description for definition of an industrial user. For orders over 3000 gallons please call our office for a quotation.

What is the definition of an ‘Industrial User’?

HMRC Internal Manual ‘VAT Water and Sewerage Services’ explains the VAT liability of water supplies, sewerage services, hot water, steam and other related supplies (https://www.gov.uk/hmrc-internal-manuals/vat-water-and-sewerage-services)

Charges for water services supplied to “industrial customers” are subject to VAT at the standard rate. Document VWASS2200 defines ‘Industrial Customers’ as business’s whose predominant business activity falls within the SIC Codes contained in the table below:

| Division | 1980 SIC | 1992 equivalent | 2003 equivalent | 2007 equivalent |

| 1 | Energy and water supply industries | C Mining and quarrying | C Mining and quarrying | B Mining and quarrying |

| D Manufacturing | D Manufacturing | C Manufacturing | ||

| E Electricity, gas and water supply | E Electricity, gas and water supply | D Electricity, gas, steam and air conditioning supply | ||

| 2 | Extraction of minerals and ores other than fuels; manufacture of metals, mineral products and chemicals | C Mining and quarrying | C Mining and quarrying | B Mining and quarrying |

| D Manufacturing | D Manufacturing | C Manufacturing | ||

| 3 | Metal goods, engineering and vehicles industries | D Manufacturing | D Manufacturing | C Manufacturing |

| 4 | Other manufacturing industries | D Manufacturing | D Manufacturing | C Manufacturing |

| 5 | Construction | F Construction | F Construction | F Construction |

If your company’s business activities are within any of the above SIC’s then VAT will be charged according to Document VWASS3000

Document VWASS3000 summarises the VAT liability of emptying Cesspools, Septic Tanks, sewerage service fot Industrial as standard-rated in the following table.

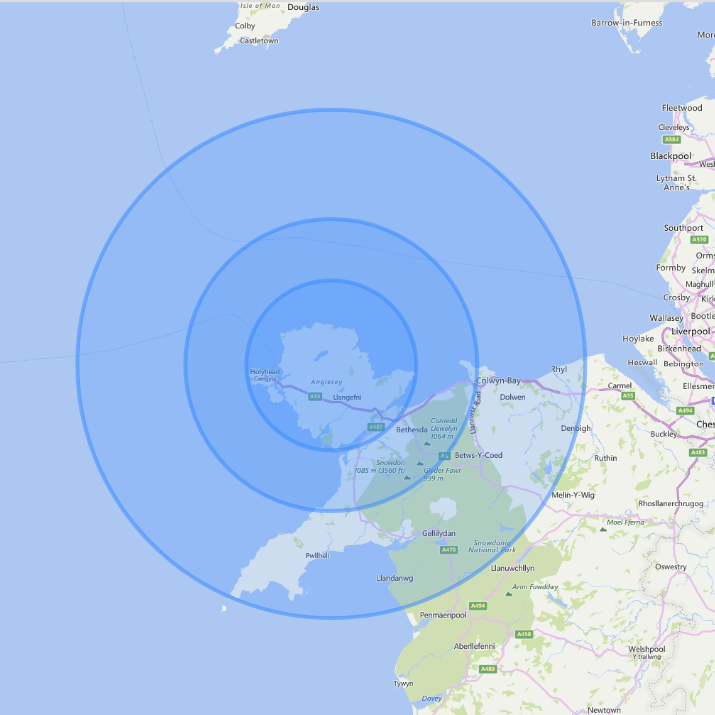

| Tank Size | Up to 1000 gallons, Up to 2000 gallons, Up to 3000 gallons |

|---|---|

| Delivery Area | Area 1, Area 2, Area 3 |

| Days | Standard 5 Day Service, Next Day Service |

You may also like…

Uncategorised